III: Getting Results

Please read previous posts first, Part I & Part II, before continuing.

About a year after reading I Will Teach You To Be Rich and putting some of the concepts into practice, I was seeing progress.

- earn cash rewards. Check

- pay monthly credit balance. Check

- set a budget. Check

- stick to my budget. Half a check

- open a 403b. Check

I was proud of myself, and I felt good.

However, I was not making significant progress on my student or car loan. And I still wanted to have them paid off by my thirtieth birthday which was now two and a half years away.

Debt has become something our society says is normal. We are taught to believe the lie that “Everyone is in debt. It’s just a part of life.”.

Thankfully, that year, my church became focused on helping families and individuals achieve financial freedom through Dave Ramsey’s Financial Peace University (FPU).

I had previously heard about FPU from a co-worker who had been through the program. She and her husband used Ramsey’s method to pay off almost $80,000 of debt in a little over three years.

I knew if they could do it, I could too. I looked at their $80,000 and thought “If two people can eliminate that much debt, as a single woman, I could tackle half that amount.”

I felt so encouraged and inspired. I enrolled in Ramsey’s class that fall, and it seriously changed my financial life.

Taking his course provided the steps I needed to reduce and ultimately eliminate my debt.

Ramsey’s method is simple, but effective, and is founded on what he calls “Dave Ramsey’s 7 Baby Steps”.

I was able to payoff $31,750.97 of debt.

The course takes participants through a series of lessons over 13 weeks. Participants are given a course guide and videos that teaches them about these seven steps.

The course takes participants through a series of lessons over 13 weeks. Participants are given a course guide and videos that teaches them about these seven steps.

From the very first class, I was blown away. Ramsey immediately addressed some of the money mistakes I made over the years and taught me a proven method of paying off debt.

I did the online program and never missed a single week. I made a weekly date with myself on the same day at the same time each week. I was committed.

At the end of the program, I had the knowledge I needed to really tackle my student loan and car debt. I started to become intentional with my money. I no longer wanted to hand over hundreds of dollars to someone else.

Using his debt snowball method along with practicing self-control and discipline, I was able to pay off $31,750.97 by my thirtieth birthday!

I’ve outlined below what I did to pay off both of those debts.

Refinancing

First, the summer before I started FPU, I refinanced my car for a lower interest rate, but I continued to make the same payments. Essentially, I was paying an extra $150 per month towards my car loan.

Tackling Baby Steps 1 and 2

Using the debt snowball method, I aggressively tackled my student and car loan while saving for my emergency fund.

One thing I did to help with these steps was to examine my budget and make some adjustments.

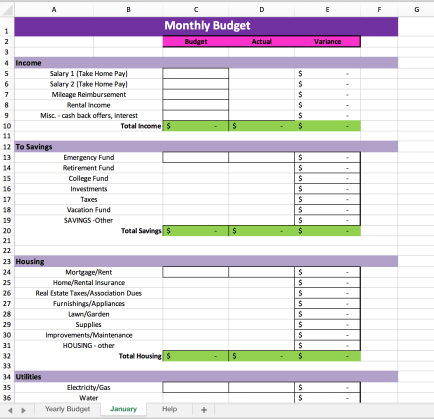

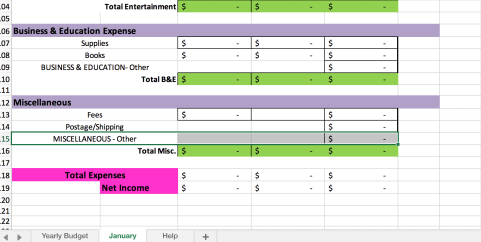

I knew that I needed another budgeting tool in addition to Mint. Because Mint only allows users to see their past budgets and current monthly budget, I needed a tool that would help me see my budget over the course of the year and also see loan payments over the course of time.

After doing some research online, I found several free loan payoff spreadsheets and yearly/monthly budget trackers. I customized the spreadsheets to meet my needs and combined them into one tool with different sheets.

Using these spreadsheets helped me to balance my budget. I was able to see and project how much “extra” money I had that could be put towards my debt and how long it would take me to pay them off.

Earning Extra Income

In addition to my regular job, I also got a side hustle. I’ve always worked during the summers and did extra duties during the school year, but in addition, I began tutoring students. I figured out how much additional income I needed, and I worked towards that. Any additional income, including my tax returns, went to paying on these loans.

The Payoff

I started paying on my student loans in December of 2009, and I continued to make the minimum monthly payments until the fall of 2013 when I began to pay extra. I made my final loan payment in 2014.

From the date of my car refinance in July 2013, I paid off the balance of $18,452 in 20 months.

By August 2015, I paid off a total of $31,751 of debt. Right on time for my upcoming 30th birthday.

Timeline

2009 – Started paying on my college loans

2010 – Purchased a home

2011 – Purchased a new car

2012 – Read Sethi’s book

2013 – Refinanced car and started FPU

2014 – Made final student loan payment

2015 – Made final car payment

I should note that there was one aspect of Ramsey’s guideline that I did not follow. Ramsey feels strongly against credit cards and advises his listeners to avoid them. He tells listeners and participants in his courses to use cash so that they can feel the spending.

While I completely understand this method, I chose not to apply this principle. Instead, I continued to use my credit card AND continued to pay my monthly balance in order to take advantage of the cash rewards offers.

Final Words

My story is not uncommon. Do a quick Google search, and you will find many inspiring stories of people paying off large amounts of debt.

One of the great things about this journey is knowing that I can share what I have learned with others. If you’re in a similar situation know that it can be done. You can be debt-free.

Debt has become something our society says is normal. We are taught to believe the lie that “Everyone is in debt. It’s just a part of life.”

Don’t believe it. I could also go into religious principles and quote scriptures about being good stewards over our finances, but for this post, it’s unnecessary.

Just know, you don’t have to live a life shackled to debt.

I know comparatively, I may not have had as much debt as the average American. I know that not everyone is able to work part-time. But despite what others may say, I am still an example that financial freedom is possible no matter where your starting point is.

Is it easier if you have a high paying job? Absolutely. Is it easier if you have help from family? Absolutely. But if you don’t have those things, do not disqualify yourself. I didn’t.

With similar steps and changes, you can turn your finances around.

Now that I am married, my husband and I are working on his debt using the same principles. When we got married, he had almost $9,000 of credit card debt and had almost $39,000 of student loan debt.

In the first five months of our marriage, we paid off all his credit card debt using a mix of the debt snowball method and the debt avalanche method.

This has not been easy because we have different approaches to finances. My husband is a spender all the way, and he loves electronics and gadgets. But we’re working together to find a balance of enjoying our money and eliminating debt.

Let this be the year you take control of your finances.

Helpful Resources:

Throughout these posts, I mentioned some of the resources that I used during that time. Below is a list of other resources I came across but did not mention.

- Eric Williams of Words of Williams

- I read his book It’s Your Money

- 52 Week Savings Plan

- You can find this Plan almost everywhere. I first heard about it here from lifestyle blogger Mandy Rose.

Finally, if you have any questions or are interested in any of the budget spreadsheets, feel free to contact me.

Leave a comment